Definition of Price to earning ratio

The price–earnings ratio, also known as P/E ratio, is the ratio of a company’s share (stock) price to the company’s earnings per share. The ratio is used for valuing companies and to find out whether they are overvalued or undervalued.

Meaning of P/E Ratio:

It is a financial ratio which helps to analyze a company value it helps to track weather a company is overvalued or undervalued in relation with its share price

For example – Mahindra and Mahindra is automobile company its current share price is 2700 Rs so by looking at stock price we cant find weather Mahindra and Mahindra is overvalued or undervalued in order to do that we will take a help of ratio which helps to identify company value which is known as p/e ratio.

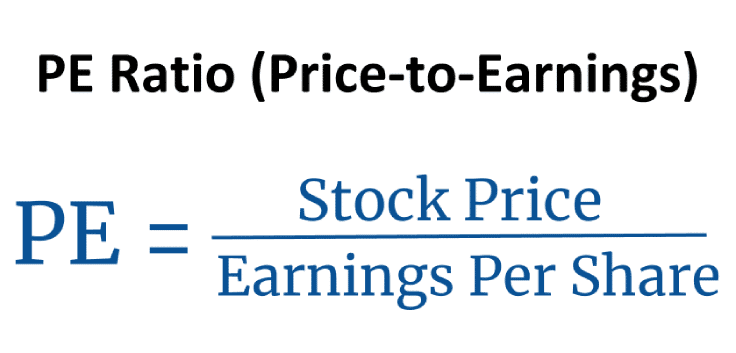

Formula of p/e Ratio:

To compute This ratio Divide a company share price with its Earning per share

Uses of p/e ratio:

This ratio is used for analyzing the valuation of a company

This ratio helps to identify weather a company is undervalued or overvalued

This ratio is tool which uses in stock market investing

This ratio compares price of share with its current earnings

Importance of P/E ratio for stock market investors:

This ratio saves a investor to invest in an overvalued share.

This ratio gives a margin of safety to investor its always better to own a low p/e ratio company than a high one.

This ratio helps to make substantial amount of return in a proper time period.

This ratio is used to check froth in the market and in an individual stock.

This ratio check the overall valuation of the Indices like nifty 50, Sensex etc.

Criteria of using this ratio

Typically, the average ratio is around 20 to 25. Anything below that would be considered a good ratio, whereas anything above that would be a worse ratio. But it doesn’t stop there, as different industries can have different average ratios. a undervalued ratio is something around 4 to 5 multiple that’s what you should look for Multibagger returns.

Conclusion:

A P/E ratio is very important tool for an investor to check company valuations it saves an investors for big losses in the market so always check a company P/E ratio before investing in any company share no matter how good a company buying at a reasonable valuations helps to make money in the market so always check a company P/E before making any investment decision always look for companies which have multiple of less than 20 and check others necessary factors like management , Goodwill of a company, Financial statements etc.

Check out our other posts:

https://dalalstreetupdates.com/nifty-50-gains-187-points-on-monday/

https://dalalstreetupdates.com/what-is-price-to-earning-ratio-uses-of-it/

https://dalalstreetupdates.com/what-is-debt-to-equity-ratio-its-uses/

https://dalalstreetupdates.com/what-is-dividend-of-a-company/

Check for more from external sources: