Meaning of Stock Spilt:

A stock split is when a company divides its stock into multiple shares, effectively lowering the price of each share without changing the company’s market value. It’s akin to cutting a cake into smaller slices; you end up with more pieces, but the total amount stays the same. For instance, in a two-for-one split, an investor who owned one share priced at 100 Rs would end up with two shares, each worth 50 Rs but with the same total value.

Interesting Facts about Stock Split:

- A stock split is when a company increases the number of its outstanding shares to boost the stock’s liquidity.

- Although the number of shares outstanding increases, there is no change to the company’s total market capitalization as the price of each share is split as well.

- The most common split ratios are two-for-one or three-for-one, which means every share before the split will turn into multiple shares afterward.

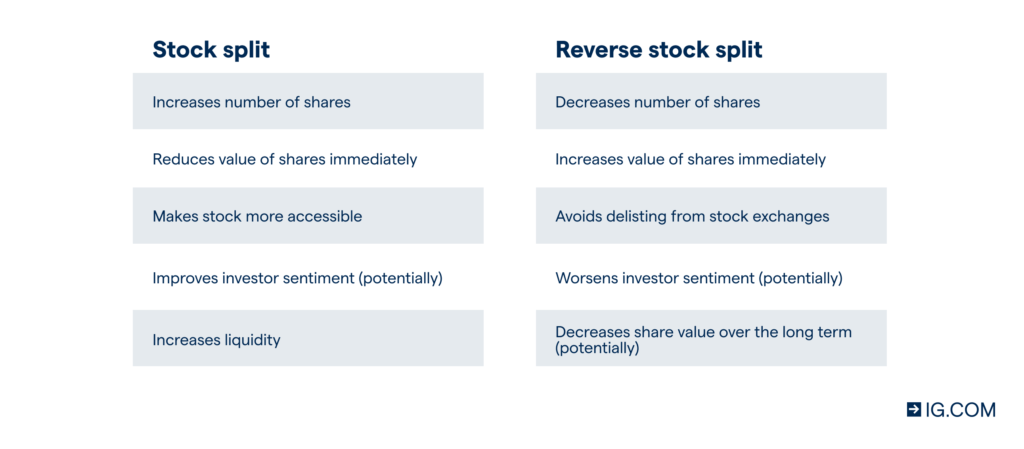

- Reverse stock splits are the opposite, in which a company lowers the number of shares outstanding to raise its stock price.

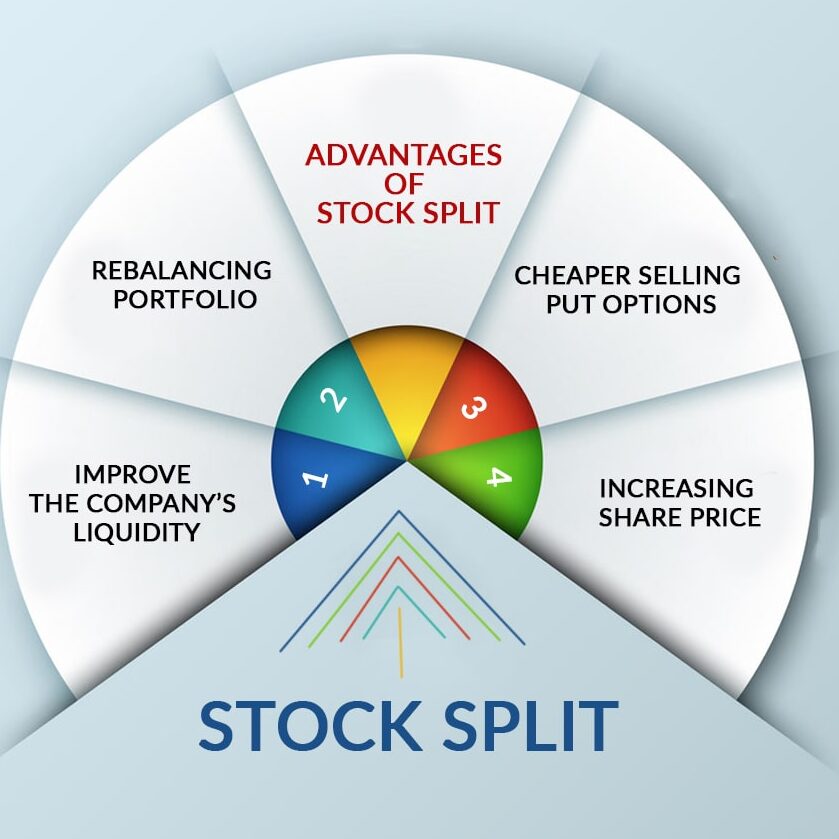

Advantages of Stock Split :

- companies see when going through the hassle and expense of a stock split. First, a company often decides on a split when the stock price is relatively high, making it expensive for investors to acquire a standard Board lot of 100 shares.

- the higher number of shares outstanding can result in greater liquidity for the stock, which facilitates trading and may narrow the Bid ask Spread. Increasing the liquidity of a stock makes trading in the stock easier for buyers and sellers. This can help companies repurchase their shares at a lower cost since their orders will have less impact for a more liquid security.

- a split, in theory, should have no effect on a stock’s price, it often results in renewed investor interest, which can positively affect the stock price. While this effect may wane over time, stock splits by blue chip companies are a bullish signal for investors. Some may view a stock split as a company wanting a bigger future runway for growth; for this reason, a stock split generally indicates executive-level confidence in the prospect of a company.

Disadvantages of Stock Split:

- One of the primary drawbacks is the cost involved: legal fees, paperwork, and shareholder communications. These costs can be substantial for smaller companies.

- potential increase in the stock’s volatility. Lower-priced shares resulting from a split may attract more speculative trading, potentially leading to greater price shifts. This increased volatility is often undesirable for all companies or investors.

- There’s also a risk that the positive effects of a stock split may be short-lived. While splits often lead to a brief surge in stock price and trading volume, these effects tend to diminish over time.

Conclusion:

Stock splits are Corporate actions that alter the number of outstanding shares and their price without changing a company’s fundamental value or market capitalization. While theoretically neutral events, stock splits often generate a positive market reaction because of increased accessibility, perceived growth signals, and behavioral factors. Companies typically carry out splits to keep share prices within a preferred range, potentially boosting liquidity and broadening their investor base. Meanwhile, reverse splits are often used to avoid delisting or improve institutional appeal.

While splits may lead to short-term price movements and increased trading, they don’t change a company’s underlying worth or an investor’s proportional ownership. Investors should focus on a company’s fundamental business prospects rather than being swayed by the cosmetic changes of a stock split. However, being aware of split dynamics can provide insight into how market psychology often affects prices. It can also potentially help you locate mispricing opportunities.

Check out our other posts:

https://dalalstreetupdates.com/peter-lynch-investing-lessons-from-his-book/

https://dalalstreetupdates.com/cash-flow-statement-meaning-and-uses/

https://dalalstreetupdates.com/what-is-price-to-earning-ratio-uses-of-it/

https://dalalstreetupdates.com/what-is-debt-to-equity-ratio-its-uses/

https://dalalstreetupdates.com/what-is-dividend-of-a-company/

Check out for more from external sources: