Meaning:

Definition – It is the study of the trend of the same items, group of items and computed items in two or more balance sheets of the same business enterprise on different dates.

Meaning – Balance sheet of an enterprise as on two or more dates is used for comparing assets , liabilities and capital and ascertaining increase and decrease in those items. It is horizontal analysis of in which each item of assets , equity and liabilities is analyzed horizontally for two or more accounting periods. Such analysis often yields considerable information which is of value in forming the opinion regarding the progress of an enterprise.

Advantages of balance sheet:

- More realistic approach: It shows the balance of accounts after closing the books at a certain date, whereas a comparative shows not only the balances of accounts as at different dates but also the extent of there increase or decrease between these dates.

- Reflects trend: It is more useful in comparison to a single year’s balance sheet because it enables studying the nature, size , and direction of change in various items of balance sheet.

- Link between balance sheet and statement of profit and loss: It shows the effects of business operations on its assets, liabilities and capital.

- Facilitates planning: It helps determining trends of assets , liabilities and capital which in turn helps in planning.

Uses of balance sheet:

- It company helps to analyze the company total assets with its total liabilities

- It helps to identify about company financial health that how much company owns and how much company owes.

- It is a important financial statement which is often used by investors and creditors of the company to check company status.

- It helps to track the company progress over the period of time.

- It is also used to track the financial ratios like debt to equity ratio etc. which measures the solvency of the enterprise.

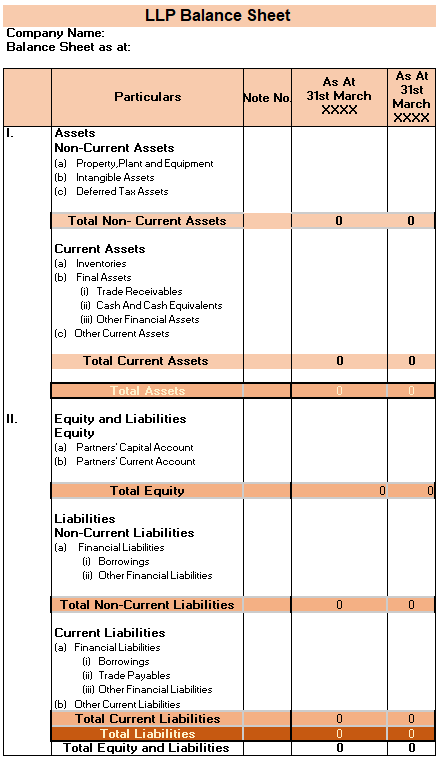

Format of balance sheet:

Importance of balance sheet:

- Financial planning and decision making – It is used in financial planning of a company by checking its assets and liabilities and helps to make financial decision.

- Securing Financing – Lenders before giving loan to a company check its balance sheet to analyze its assets and check its financial health before granting loan to the company so by giving loan to a company who has strong fundamentals helps lenders to secure there finance which reduces the chances of defaults.

- Complying Accounting standards and tax regulations – It is also vital for complying with accounting standards and tax regulations. it helps to analyze necessary information to accurately calculate business tax liability.

Conclusion:

Balance sheet is very important financial statement of company to analyze its assets and liabilities and make financial decision on the basis of it other than profit and loss statement and cashflow statement so it is very important check this financial statement before investing in a company because it helps to identify the solvency of a company and helps to track various financial ratio with the help of this statement so before taking any financial decision like lending money or investing in a company make sure to check this statement to decrease the chances of default or company bankruptcy in bad times.

Check out our other posts:

https://dalalstreetupdates.com/cash-flow-statement-meaning-and-uses/

https://dalalstreetupdates.com/nifty-50-update-today-sensex-update/

https://dalalstreetupdates.com/nifty-50-gains-187-points-on-monday/

https://dalalstreetupdates.com/what-is-price-to-earning-ratio-uses-of-it/

https://dalalstreetupdates.com/what-is-debt-to-equity-ratio-its-uses/

https://dalalstreetupdates.com/what-is-dividend-of-a-company/

Check out for more from external sources: