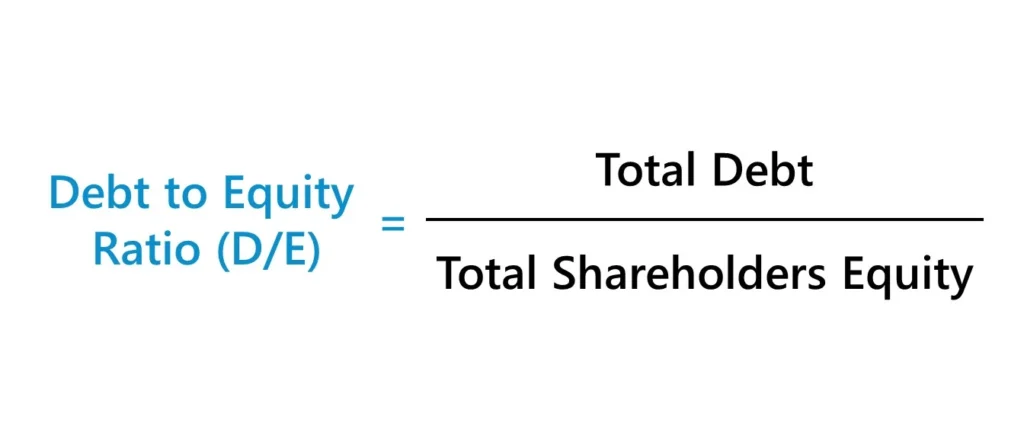

Definition of Debt to equity ratio

Debt to equity ratio is computed to assess long term financial soundness of the enterprise. which means company is able to meet its long term financial obligations in the future the ratio expresses the relationship between long term external equites which means external debts and internal equities which is shareholders funds of the enterprise.

Debt to equity helps a investors to access a company financial health a low ratio indicates that company has less debt and will not face problems related to debt in near future while a high ratio indicates that company has high debt and can face problems in near future due to various factors so to get rid of it this ratio was introduced which compares total debt with total shareholders funds if shareholders fund is more than total debt then it means company is relying on shareholders money as compared to debt money which makes a company debt free or a low debt company and which most of the shareholders and investors look for because debt is merciless it is often said to stay away from debt.

Note

A High Debt to Equity Ratio means that the enterprise or company is depending more on borrowings or debts as compared to shareholders funds. in effect , lenders are at higher risks and have lower safety. on the other hand , low debt to equity ratio means that the enterprise is depending more on shareholders funds than external equites. in effect, lenders are at a lower risk and have higher safety

Normally debt to equity ratio of 2:1 considered as an appropriate ratio.

Objective and Significance

The objective of debt to equity ratio is to measure the proportions of external funds and shareholders funds invested in the company. this ratio assesses long term financial position and soundness of the long term financial policies of the enterprise. it also indicates the extent to which the enterprise depends on borrowed funds for its business.

Why debt to equity ratio is important for stock market investors

It is important for stock market investors because it helps to analyze how much long term debt company is dependent on and how much companies is dependent on shareholder funds a high debt to equity ratio is not a good sign for investors because company is at higher risk to get bankrupt if not paid debt on time and due to some reason company business gets affected how will company will pay to its debtors. on the other low debt to equity ratio is considered safe as company is less dependent on debt and more on shareholders fund which will not lead a company to bankruptcy.

Conclusion

In short from the above study we can say that a company with lower ratio is better than a company with higher ratio so when it comes to investing in a stock always check it debt to equity ratio and compare this ratio from its peers and see which has lower ratio and which has higher avoid company which ratio is too high an average ratio is fine but avoid companies with too much high ratio and always compare companies in a same industry for example – comparing a FMCG company with another FMCG company so this ratio very important to analyze financial situation of a company because if company is solvent than there will be no risk in the company that it will go bankrupt but companies with high debt are prone to bankruptcy because of various reason like profitability of a company , revenue from operations , Changes in trend , political issues , wars and Recession can also lead a company to bankruptcy , rising interest rate so its always safer to select a company which is debt free or have very less debt

Check out other useful educational blogs:

https://dalalstreetupdates.com/what-is-price-to-earning-ratio-uses-of-it/

For more :

https://en.wikipedia.org/wiki/Debt-to-equity_ratio