Meaning of Cashflow and Cashflow Statement.

Cash flow statement is a statement that shows the flow of cash and cash equivalents during the period under report. Cash flow are inflows which are receipts and outflow which are payments of cash and cash equivalents and transactions that increase cash and cash equivalents are inflows of cash and cash equivalents and transactions that decrease the cash and cash equivalents are out flows of cash and cash equivalents. Meaning of cash and cash equivalents include cash , bank balance , Marketable securities etc.

Example of cash flows:

Cash inflows includes the following things :

- Cash sales

- Cash received against trade receivables

- Cash received for Commission and Royalty

- Insurance claim received

- Cash received from sale of investment ( other than marketable securities)

- Cash received from sale of fixed assets

- Cash received from sale of securities

- Loans and advances received

- Proceeds from issue of equity shares

- proceeds from issue of preference shares

- Proceeds from issue of debentures

Cash outflows includes the following things :

- Cash purchases

- Cash paid against trade payables

- Operating expenses paid (e.g., Administration Expenses , Selling and distribution expenses)

- Cash purchase of investment (other than marketable securities)

- Cash purchase of fixed assets

- Loans and advances given

- Loans and advances repaid

- Payment for buy back of equity shares

- Payment for redemption of preference shares

- payment for redemption of debentures

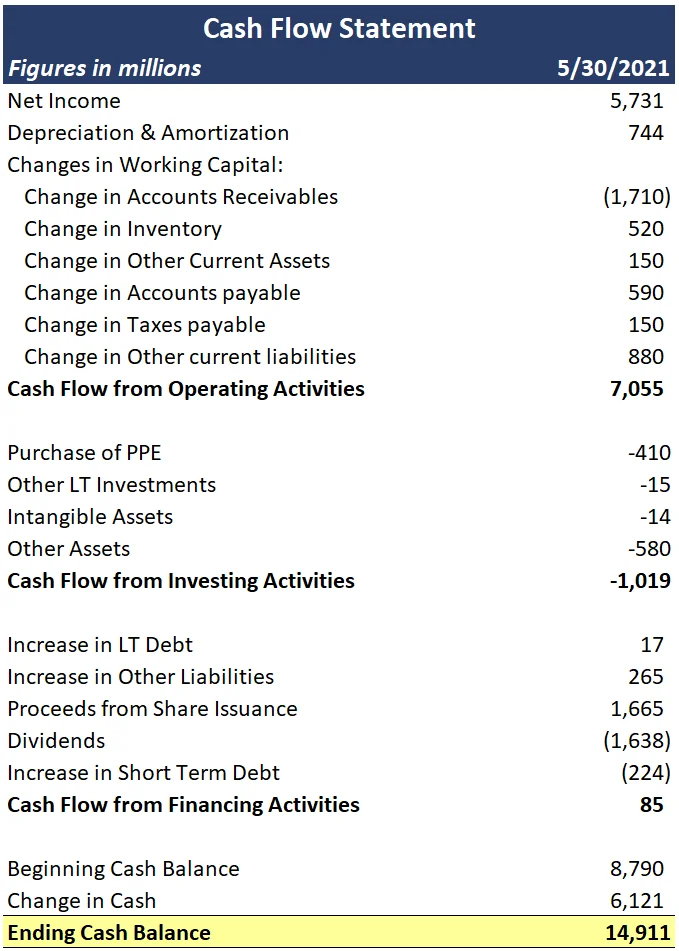

Cash flow statement the accounting standard prescribes that cash flow statement be prepared showing cash flow under three heads , namely :

Cash flow from operating activates

Cash flow from investing Activities

Cash flow from Financing Activities

Objectives of cash flow statement :

- To determine the sources (receipts ) of cash and cash equivalents under operating investing and financing activities of the enterprise.

- To determine applications (payments ) of cash and cash equivalents under operating, investing and Financing activities of the enterprise.

- To determine net change in cash and cash equivalents being the difference between sources (receipts ) and applications (payments) under operating , investing and financing activities between the dates of two balance sheets.

Importance of cash flow statement:

- Short term planning : Cash flow statement gives information about sources and applications of cash and cash equivalents for a specific period. It helps in planning investments and assessing financial requirements of the enterprise.

- Cash flow helps in Assessing liquidity and solvency : Solvency is the ability of the enterprise to meet its liabilities on time. it helps to assess liquidity.

- Efficient cash management : Cash flow statement gives information relating to Surplus or deficit in cash. An Enterprise therefore can decide about the short term investment of the surplus and can arrange the short term credit in case of deficit.

- Comparative study : A comparison of the actual cashflow with the budgeted cash flows of the year shows the extent to which cash and cash equivalents were generated and applied as per plan.

- Reasons for cash position : It shows the reason for lower and higher cash balances with the enterprise. sometimes , an enterprise has lower cash balance in spite of higher profits or has higher cash balance in spite of lower profits. Reason for such situations can be analyzed with the help of this statement.

- Evaluate Management Decision : It provides information relating to company investing and financing activities, gives the investors and creditors information about cash flow which helps them to evaluate management decisions.

- Dividend Decision : Dividend payable is deposited in a separate bank account upon it being declared i.e., interim dividend ) or approved i.e., Final dividend . it helps in deciding how much dividend should be paid.

Limitations of cash flow statement

- Non cash transaction are not shown :Cash flow statement it shows only inflows and outflows of cash. it does not show non cash transactions like the purchase of building by issue of shares or debentures to the vendor or issue of bonus shares.

- Not a substitute for an income statement : Income statements shows net income of enterprise based on accrual basis of accounting whereas it shows only cash inflows or outflows which does not represent net profit earned or loss incurred by the enterprise.

- Not a substitute for balance sheet : Cash flow statement is not a substitute for balance sheet because it does not show the financial position (i.e., Equity liabilities and assets).

- Historical in Nature : Cash flow statement rearranges available information in the income statement and the balance sheet thus, it is historical in nature.

- Assessment of liquidity : Liquidity of an enterprise cannot be determined from Cash flow statement alone because it depends on other factors also like current assets and current liabilities. Cash and cash equivalents is one of the components of current assets.

Classification of cash flows :

The changes resulting in inflows and outflows of cash and cash equivalents be classified into three activities, i.e., Operating, Investing and Financing. These are discussed below:

(i) Operating activities – Operating activities are the principal revenue producing activities of the enterprise and other activities that are not investing or financing activities. Cash flow from operating activities being the principal revenue producing activities of the enterprise. Generally results from the business transactions and events that determine net profit or loss.

Example of cash flow from operating activities:

For non financial companies

- Receipts from sale of goods and/or rendering of services.

- Receipts from royalties, fees and commission, etc.;

- Receipts from trade receivables.

- Payment for purchase of goods and services.

- Payment to trade payables.

- Payment of wages , salaries and other payments to employees;

- Receipts of premium and payment of claims (for insurance companies).

- Payment of and refund of income tax unless these are identified with investing or financing activities.

For Financial companies

- Payment for purchase of securities.

- Payment of interest on loans.

- Receipts from sale of securities.

- Dividend received on securities .

- Interest received on loans granted.

- Payment of salaries , bonus , etc. to employees;

- Payment of and refund of income tax and unless these are identified with investing or financing activities.

(ii) Investing Activities – investing activities are the acquisition and disposal of the long term assets and other investments, not included in cash equivalents. these activities include transactions involving purchase and sale of the long term assets, which are not held for resale such as machinery , land and cash and cash equivalents such as current investments other than marketable securities. investments include investments made in a long term investments by the enterprise with a purpose to generate income and thus, cashflow.

Example of cash flow form investing activities are :

- Payment for purchase of fixed assets (including intangible assets ).

- Receipts from disposal of fixed assets ( including intangible assets ).

- Payments to purchase ( acquire ) securities i.e., shares ,warrants ,debentures ,bonds.

- Receipts form sale of securities.

- Advances and loans made to third parties .

- receipts from repayments of advances and loans made to third parties.

(iii) Financing Activities – Financing activities are the activities which results in change in size and composition of owners capital (including preference share capital in the case of a company ) and borrowing of the enterprise form the other sources. Thus, increase in share capital ( equity and preference) redemption of debentures , increase in borrowings (short term and long term ) , repayment of borrowings (short term and long term) and redemption of debentures etc., are shown under financing activity.

Example of cash flow from financing activities are :

- Proceeds from the issue of shares or other similar instruments.

- Proceeds from the issue of debenture , Loans , Bonds and short term borrowings.

- Payment for buy back of equity shares.

- Repayments of the amounts borrowed including redemption of debentures.

- Payments of dividends both on equity and preference shares.

- Payments for interest on debentures and loans (short term and long term).

- Increase or decrease in bank overdraft and cash credit.

Conclusion :

Cash flow statement is used to identify the inflows or outflows of cash and cash equivalents under three sections operating activities , Investing activities , Financing activities I company maintains a good net cashflow than it is a good sign that company is solvent and have enough cash to fulfill its short term demands when we analyze cash flow it is said that operating cash flow should be always positive and investing and financing activities should be negative so whenever we think to invest in a company always check its cashflows before investing because it is a very important financial statement of a company to understand company financial health other than balance sheet and profit and loss statement.

Format Of Cash flow statement:

Check out our more posts:

https://dalalstreetupdates.com/nifty-50-update-today-sensex-update/

https://dalalstreetupdates.com/nifty-50-gains-187-points-on-monday/

https://dalalstreetupdates.com/what-is-price-to-earning-ratio-uses-of-it/

https://dalalstreetupdates.com/what-is-debt-to-equity-ratio-its-uses/

https://dalalstreetupdates.com/what-is-dividend-of-a-company/

Check out for more from external sources: